This post was originally published on this site

Highflying technology stocks have seen extreme swings in recent trade and investors are wondering what’s ahead for a category of equities that have helped to propel the broader market and the Nasdaq Composite Index from out of the depths of the coronavirus crisis.

Despite a rebound in the Nasdaq Composite COMP, +0.94% on Tuesday, the reverberations of a historic Monday reversal in the technology-laden index were still being weighed for the potential to signal whether a powerful uptrend for tech and tech-related stocks was petering out.

Indeed, after rallying just under 2% to an intraday record high on Monday, the Nasdaq closed 2.1% lower.

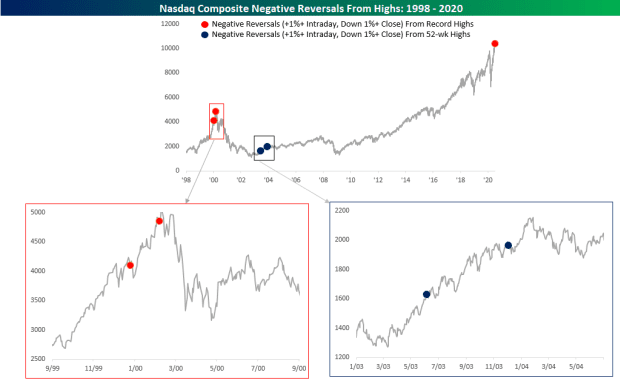

Analysts at Bespoke described the U-turn for the benchmark as uber rare. In fact, there have only been two other occasions in which the Nasdaq has closed lower after hitting a record intraday high:

“Those two days were 1/24/00 and 3/7/00 (red dots in chart below), and although the Nasdaq was up the following day both times, you don’t need us to remind you what happened over the long-term from there,” the Bespoke analysts wrote in a report dated July 13.

The tech-laden Nasdaq, and the more concentrated Nasdaq-100 NDX, +0.82%, have come to unequivocally exemplify the unmitigated surge from the equity market’s March 23 lows, even as the economy is reeling from the effects of a pandemic that appears out of control in a number of U.S. states. The Nasdaq is up 53% from that March low, while the Nasdaq-100 has rallied by about 53%. By comparison, the Dow Jones Industrial Average DJIA, +2.13% and the S&P 500 SPX, +1.34% have risen 43% over the same period.

Jason Goepfert, head of SentimentTrader and founder of independent investment research firm Sundial Capital Research, said that Monday’s action highlighted a number of odd developments that have emerged as a tech has soared.

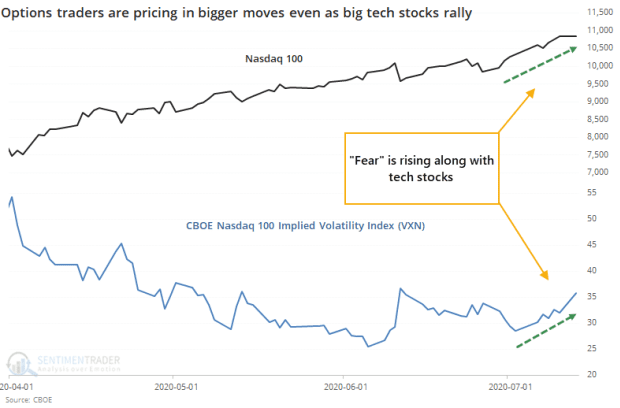

Goepfert noted back on Monday that that Nasdaq-100, consisting of the biggest members of the Nasdaq Composite, was rising at the same time that a measure of volatility for that benchmark, the Cboe Nasdaq Volatility Index, or VXN, referring to its ticker symbol, was also climbing.

Because volatility gauges, like VXN, reflect expectations for coming volatility in an benchmark and tend to rise as the underlying index falls, it is rare to see them move in tandem. In fact, Monday’s side-by-side climb for the Nasdaq-100 and the VXN had never occurred before, according to SentimenTrader (see attached chart via SentimenTrader).

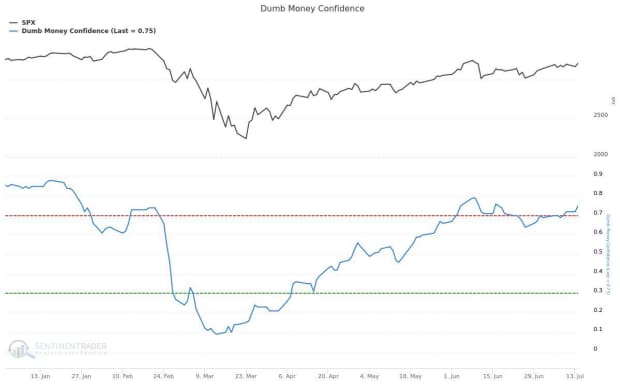

Goepfert also noted that a measure of the confidence of retail investors, colloquially referred to as “dumb money” was near its highest level since June 8 at around 075, which represents the S&P 500’s most recent peak.

All that said, market participants can’t draw a lot of conclusions about how tech stocks and the broader market will perform. Primarily because few, if any, have been through a pandemic of this magnitude that has driven the global economy into a recession. On top of that, markets can remain irrational longer than investors can remain solvent, to paraphrase a quote from famed British economist John Maynard Keynes.

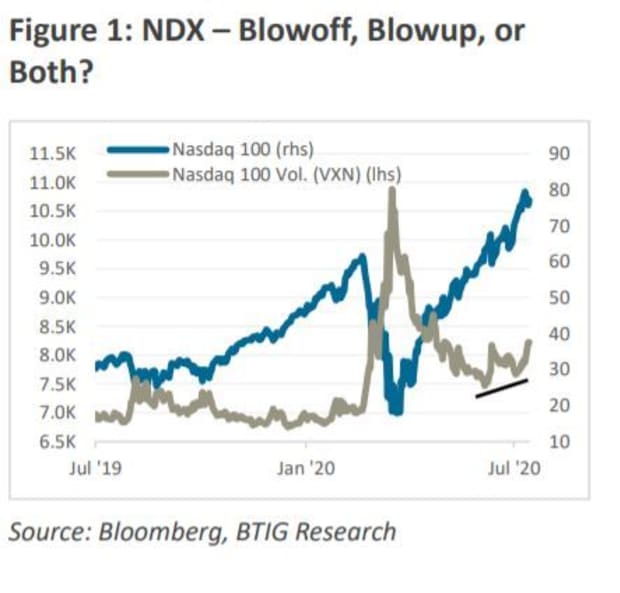

BTIG’s chief strategist Julian Emanuel also highlighted another quirk of this current market dynamic, pointing out that there has been a shift been the VXN and the S&P 500’s volatility index that may bode ill for at least the tech sector. The analyst said that VXN trading at a premium (37.61) to the S&P 500’s volatility index (29.52), referred to as the VIX, is also an uncommon phenomenon.

“As questions mount about whether the surge in VXN in recent weeks, uncharacteristic in a rising NDX tape, is indicative of a ‘blowoff’ or a ‘blowup’ or both (Figure 1) we note that such ‘fast and furious’ shifts between VXN and VIX have tended to correspond to NDX absolute and relative underperformance, especially on a 3-month time frame,” Emanuel wrote, along with analyst Michael Chu, in a July 14 research note.