This post was originally published on this site

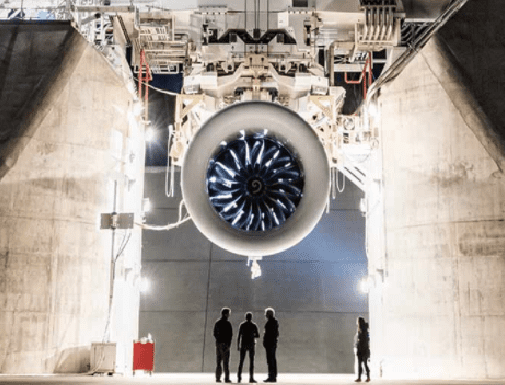

General Electric Co.

Shares of General Electric Co. surged to the highest price seen in four months before pulling back, as Wall Street has gotten a little more optimistic on the outlook ahead of the industrial conglomerate’s earnings report.

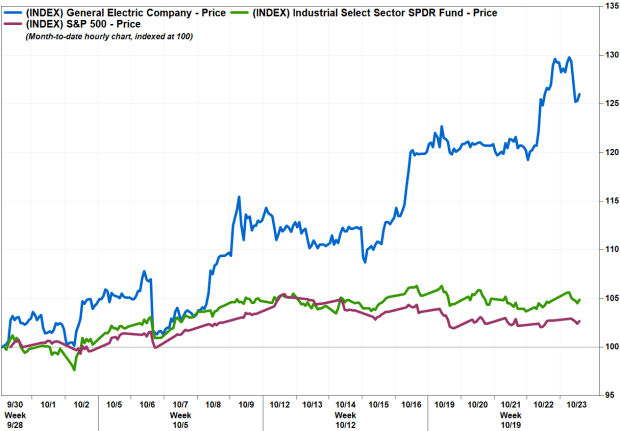

The stock GE, -1.10% climbed as much as 4.0% to an intraday high of $8.03, the highest price seen since June 9, before pulling back to trade down 0.7%. It has still soared 23.0% in October, making the stock the best month-to-date performer among the SPDR Industrial Select Sector exchange-traded fund’s XLI, +0.35% components, and the fourth-best performer in the S&P 500. SPX, +0.34%

GE is scheduled to report third-quarter earnings on Oct. 28, before the market opens. The average estimate of analysts surveyed by FactSet is for GE to swing to an adjusted loss of 4 cents a share from earnings of 15 cents a share a year ago. Revenue is expected to be $18.72 billion, up from an estimate of $18.69 billion at the end of September, but down from $23.36 billion a year ago.

Analyst Markus Mittermaier at UBS reiterated the buy rating he’s had on the stock since December 2019, but bumped up his price target to $9.00 from $8.50. He said recent comments from GE management that second-half 2020 free cash flow (FCF) would be positive has given him confidence in this 2H FCF estimate of $2.5 billion, which is above Wall Street expectations of about $1.75 billion.

Don’t miss: GE’s stock surges to best 2-day rally in 6 months after CEO Larry Culp’s upbeat comments.

He acknowledges that more clarity on second-half cash flows is “necessary but not sufficient” for the stock to work, as he expects near-term volatility related to COVID-19 and sentiment on air travel, with new coronavirus case numbers likely to get worse before they get better. See MarketWatch’s coronavirus update.

However, Mittermaier said he believes GE investors are increasingly focusing on the outlook for FCF up to 2022 and beyond.

And data from the Transportation Security Administration showed the number of daily travelers had topped the one-million mark earlier this week for the first time since mid-March.

See related: GE’s stock gets a big boost after news that Boeing’s 737 MAX could fly again this year.

“[O]n a 12-month basis, we see significant upside in the stock,” Mittermaier wrote in a note to clients. “We think this is currently the most vaccine-levered stock in our coverage.”

And GE investors received good news on the vaccine front late Thursday, as the Food and Drug Administration approved the first COVID-19 treatment, Gilead Sciences Inc.’s GILD, +0.19% Veklury, for patients who have been hospitalized with COVID-19 infections.

Read more: Doctors question FDA approval of Gilead’s COVID-19 treatment and say it has limited benefits.

FactSet, MarketWatch

Wolfe Research analyst Nigel Coe is also upbeat on what a vaccine could mean for GE’s stock, and for GE’s aviation business, at a time when consensus Wall Street estimates are more bearish for that business versus GE’s peers. And with estimates now “well calibrated for this deep trough,” Coe thinks the stock is “too cheap” at current levels.

He thinks investor sentiment toward GE will move in tandem with global airline capacity, thus making GE the “most compelling post-COVID play” within the electrical equipment/multi-industry (EE/MI) sector. While estimates could be reset lower into 2021 as the number of new cases rise, “we don’t think this matters,” Coe said, as the stock has been on a tear this month despite the recent jump in cases.

“A sharp rebound in airline passenger traffic in 2021 could be a major catalyst, since this is the single biggest value driver for the stock,” Coe wrote. “We think GE could trade disproportionately in tandem with the outlook for a commercial COVID-19 vaccine.”

Despite the recent rally, the stock has still tumbled 31.3% year to date, while the industrial ETF has slipped 0.7% and the S&P 500 index has gained 6.9%.

More on what Wall Street expects from GE earnings

Estimize, a crowdsourcing platform that gathers estimates from buy-side analysts, hedge-fund managers, company executives, academics and others, as well as from Wall Street analysts, has a consensus per-share loss estimate of 3 cents.

The Estimize revenue consensus is $18.93 billion.

The stock has declined on the day the past two earnings reports were released, by an average of 3.8%.

For GE’s business segments, the FactSet revenue consensus is $4.95 billion for Aviation, $$.48 billion for Renewable Energy, $4.14 billion for Healthcare and $3.89 billion for Power.

The average estimate, of the two analysts who provided free-cash-flow estimates to FactSet, is a negative $1.03 billion, with a range of negative $1.18 billion to negative $876 million.