This post was originally published on this site

Copying is a tried-and-true strategy. Of course it’s better to know the answers yourself, but if not, just find someone smarter who does. It’s the very essence of momentum trading — buying what others just bought. In fact the great investing trend of the last 50 years, passive investing, is just copying what some index provider put together. So here’s to mimicry. The parrot should be the official bird of Wall Street.

Another copying strategy is doing what hedge funds do. Thanks to Securities and Exchange Commission disclosure rules, you can discover most of what these investors do, albeit on a delay, but without exorbitant fees or million-dollar minimum investments.

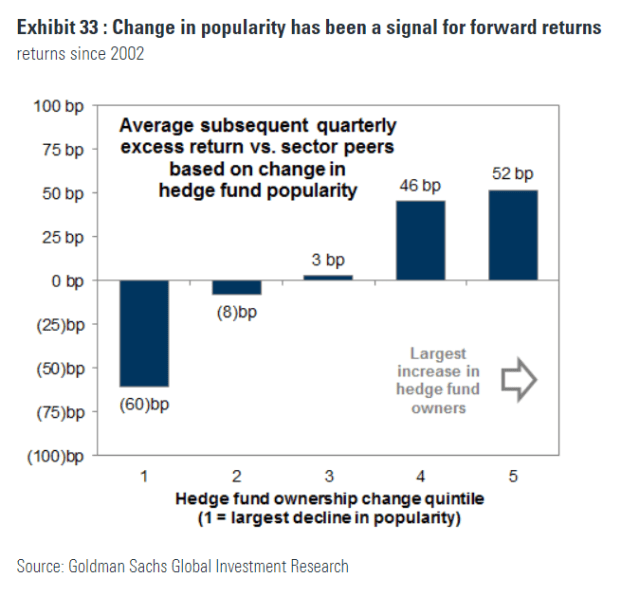

According to Goldman Sachs, during the last 18 years, stocks with the largest increase in the number of hedge-fund investors have typically gone on to outperform sector peers during the quarters following their rise in popularity. Similarly, stocks with the largest decline in number of owners have subsequently underperformed peers by a similar magnitude.

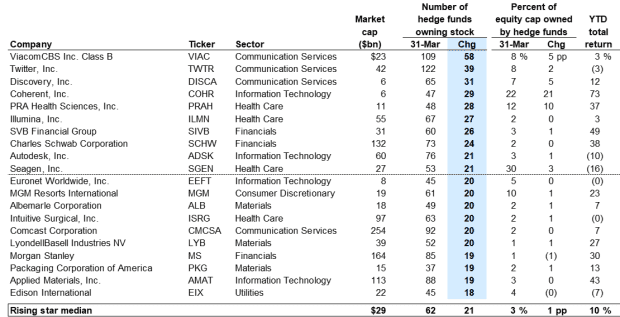

Analysts at Goldman put together the list of the stocks with the largest increase in hedge-fund owners in the first quarter after analyzing 807 hedge funds with $2.7 trillion of positions. Left unsaid by the analysts is that the top and third-most purchased stocks, media giants ViacomCBS

VIAC,

and Discovery

DISCA,

were dumped by Goldman itself as a result of the margin call that Archegos Capital Management couldn’t meet. But the other stocks on the list weren’t part of the Archegos affair, including social-media service Twitter

TWTR,

and laser-equipment maker Coherent

COHR,

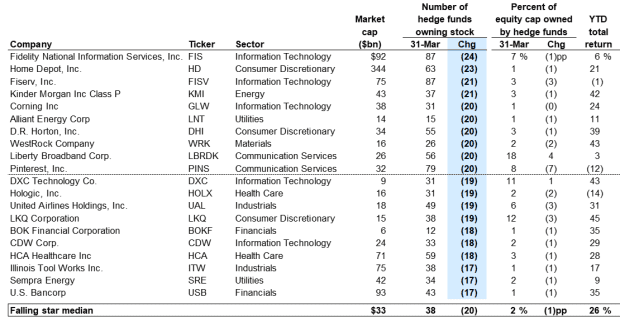

Payment-services provider Fidelity National Information Service

FIS,

home-improvement retailer Home Depot

HD,

and payments company Fiserv

FISV,

head the list of companies with the largest decrease of hedge-fund owners.

Facebook

FB,

overtook Amazon

AMZN,

as the company most held as a top-10 holding, according to Goldman.

Housing data on tap

The latest report from the housing market is due, with existing home sales figures due at 10 a.m. Eastern. The flash U.S. purchasing managers index also is set for release, as the eurozone’s composite jumped to a 39-month high in May, and the U.K. reading rose to the highest since Jan. 1998.

Microchip-equipment maker Applied Materials

AMAT,

reported record sales as it continued to benefit from the shortage in semiconductors. WeWork, the office-space company being purchased by BowX Acquisition

BOWX,

lost $2.1 billion in the first quarter. Heavy-equipment maker Deere & Co.

DE,

beat expectations on earnings and revenue.

Telecommunications provider AT&T

T,

was upgraded to buy from neutral at UBS after its planned sale of Warner assets to Discovery.

The Israeli government and the Palestinian group Hamas agreed to a cease-fire that started on Friday.

U.S. stock futures

ES00,

NQ00,

edged higher on Friday morning, while the yield on the 10-year Treasury

TMUBMUSD10Y,

was 1.64%.

Random reads

This detectorist, on his first hunt, found Roman and Viking treasures — albeit in a plastic carrier bag.

Some Japanese citizens are receiving U.S. stimulus checks, apparently accidentally.

A train driver took a bathroom break and turned over operations to an unlicensed conductor — on a bullet train running 90 miles an hour.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers