This post was originally published on this site

I’m interested in a technology platform company that had an initial public offering late last year. This isn’t like other companies you may have heard of.

Unity Software Inc. U, +1.90% provides software to create, run and monetize interactive, real-time 2D and 3D content for mobile phones, tablets, PCs, consoles, and augmented and virtual reality devices. Here’s the company’s website.

A company can build a game on the Unity platform and easily deploy it across all other platforms that people play games on — from their mobile phones, to gaming consoles and, most importantly for the future, virtual reality platforms such as Facebook Inc.’s FB, -2.81% Oculus.

The financial fundamentals are impressive, though the stock isn’t cheap. It’s growing revenue at 30% per year, and gross margins have widened, to nearly 80% last quarter. As such, I like the profitability potential in years ahead as more games and ideas for 3D virtual reality get built. Tens of thousands of those games will be built using Unity.

In the company’s 2020 S1 filing, Unity estimated that in 2019, on a global basis, 53% of the top 1,000 games on the Apple Inc. AAPL, -0.31% App Store and Alphabet Inc.’s GOOG, -0.35% Google Play were made with Unity software. In its earnings release a couple of weeks ago, Unity said that its market share had increased to 71% of the top 1,000 games in fourth quarter of 2020.

But it’s not only gaming: From the last quarterly earnings call, it seems Unity’s management team is aggressively going after non-gaming segments such as retailers and designers. Volkswagen AG VOW, +0.80% has recently used Unity’s Forma app to design a virtual e-commerce 3D showroom.

Unity CEO John Riccitiello said: “Now we believe we’re in the early phases of a once-in-a-generation technology transition, in this case, a world in which the majority of digital content is two-dimensional and moving to real-time 3D. Those of you who have followed the history of technology understand that revolutions don’t happen organically. You need change agents. For real-time 3D, we’re seeing a virtuous cycle of software and hardware innovation change agents. For example, faster GPUs, 5G bandwidth, 4K displays and new XR devices are making real-time 3D from any endpoint a reality.”

On the other hand, the stock is quite expensive, trading at 30 times next year’s revenue estimate. Unity isn’t profitable. The company will probably begin turning a profit in the next two or three quarters, and then the earnings per share can really start to grow in 2022 and 2023.

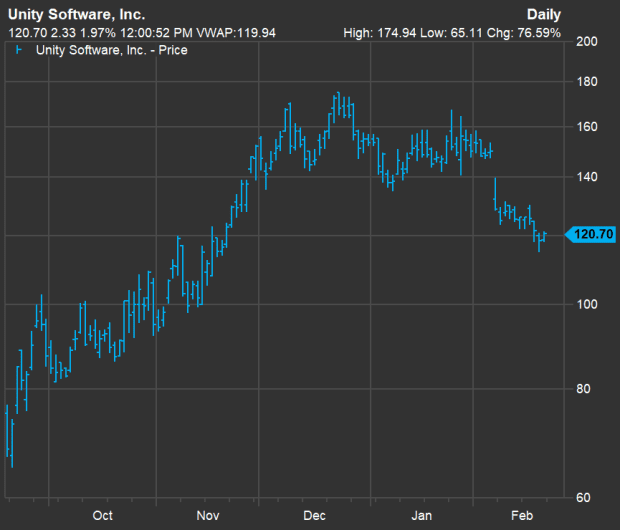

Unity priced its initial public offering at $52 on Sept. 17, 2020. (FactSet data)

I am pleased that the stock has come down after the company tamped down expectations because Apple’s new privacy policies will affect many of Unity’s game-making customers. I don’t think these new policies will slow the creation of new games or hurt the long-term revenue potential for the other gaming platforms that Unity enables these games to be played on.

And the Oculus/VR reality business that is so important to Unity’s future growth obviously isn’t hurt by Apple’s moves at all.

The stock looks like it could be ready to pop back toward its recent all-time high. More importantly, this looks like a reasonable valuation. It is time to build a long-term position in this name. I’m buying about a third or half as much of Unity shares that I eventually want to own and will probably buy the next tranche in the first part of next week. Then I’ll look to buy more if the stock pulls back.

If you want to buy the best-positioned and most Revolutionary companies, you should own this name when the stock is down.

Cody Willard is a columnist for MarketWatch and editor of the Revolution Investing newsletter. Willard or his investment firm may own, or plan to own, securities mentioned in this column.