This post was originally published on this site

Coursera Inc.’s stock bolted out of the gate Wednesday on their first day of trading with shares of the the online-education company up 20% at midday.

Shares of Coursera

COUR,

opened at $39 a share, 18% above their initial-public-offering price Wednesday, and at last check had notched an intraday high of $40.53. The IPO priced at $33 a share late Tuesday, at the high end of Coursera’s expected range of $30 to $33 a share, with the company raising $484 million.

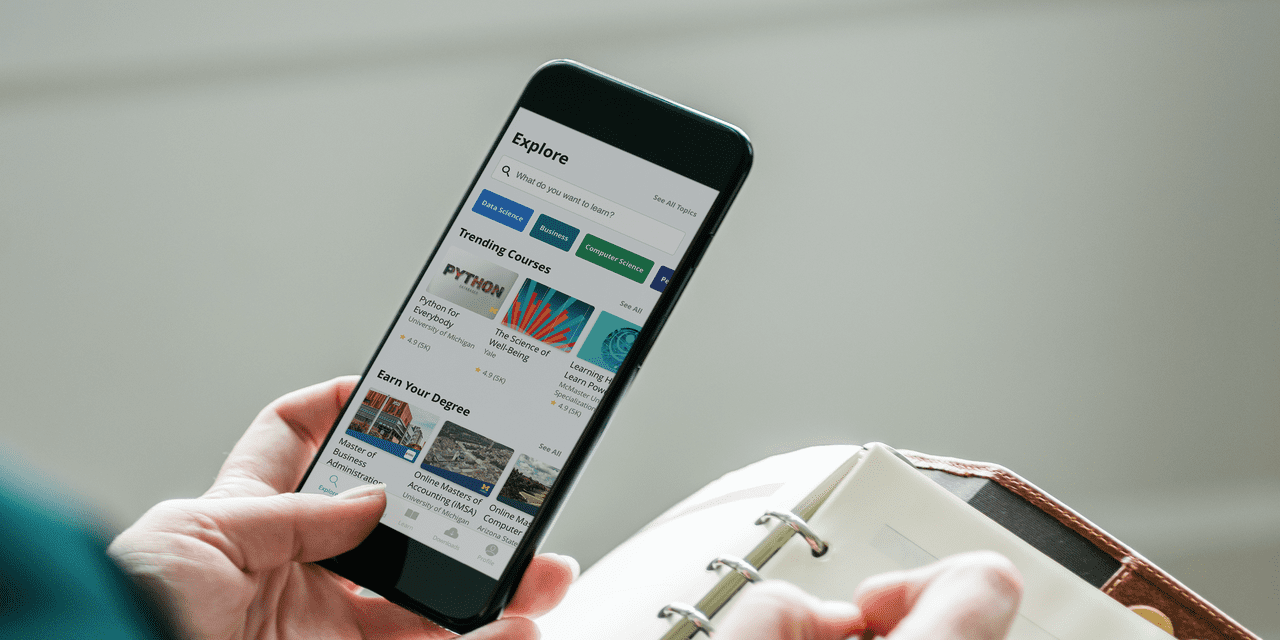

Coursera offers a variety of free and paid online classes, as well as certificate programs and enterprise-oriented skills courses for employees. The company also works with universities on degree programs, through which the schools admit and teach online courses while leveraging Coursera’s platform and technology.

Coursera IPO: 5 things to know about the online-education company

The company generated $293.5 million in revenue during 2020, up from $184.4 million in 2019. Coursera recorded a net loss of $66.8 million in 2020, whereas it posted a $46.7 million loss a year prior. As of the end of 2020, 77 million people had registered to use the Coursera platform.

Coursera sees numerous growth avenues ahead. The company is looking to grow the number of businesses using its enterprise offering while also expanding to serve more employees who work for current enterprise customers. Coursera also points to “a substantial opportunity to increase the number of bachelor’s and master’s programs in new and existing academic disciplines within our current network of university partners,” according to the company’s prospectus.

The pandemic created a growing awareness of online-education tools, Coursera said in its prospectus, and the company argues that digital learning tools could help smooth out access to quality education.

“The need for technological change in education has been exacerbated by the recent global pandemic,” Coursera said in its prospectus, predicting that the future of education could “be characterized by blended classrooms, job-relevant education, and lifelong learning” with online education serving as “the primary means of meeting the urgent global demand for emerging skills.”

Coursera’s IPO comes as the Renaissance IPO ETF

IPO,

has gained 136% over the past 12 months and as the S&P 500

SPX,

has risen 54% in that span.