This post was originally published on this site

What just happened?

What a world: after four years of teasing, it’s finally Infrastructure Week!

And after months of preparations — inflation scares, ETF positioning, sector rotations — the market largely yawned through the White House’s proposal.

MarketWatch and ETF Wrap will, of course, continue to track all the developments with the spending package, and keep you updated on the best ideas on how to play it all (here’s a Wednesday round-up of ETF suggestions.)

In the meantime, please enjoy a very special edition of ETF Wrap. The cover art is the only April Fool’s Day joke, we promise. What could be more serious than our big reveal: the winner of our First Annual Totally Unofficial Completely Unserious ETF Idea Contest?

The FATUCUEIC was both fun and educational. As our judge, VIA Investment Advisory President Amrita Nandakumar, put it: “It was very interesting to review the entries and see firsthand which themes are currently resonating with people. The winning entry is a particular reminder that investors ultimately aren’t seeking investment products, they are seeking investment solutions.”

Thanks for reading — and we hope you enjoy reading about the contest winner as much as we did writing about it.

Stuck in the middle with you

When we announced a contest for the best new ETF idea, we had no idea just how creative and thoughtful our readers would be. Wrap received proposals covering everything from inflation to artificial intelligence. Still, two entries rose to the top.

The winning submission has an ambitious — and relatable — goal that attests to a curious mind, thorough research and deep understanding of personal finance and financial markets.

That entry came from Jennifer Fitzpatrick, a reader from Tennessee, who described it as “a fund that a Gen X investor can use to support both boomer parents and nesting millennials while still growing capital sufficiently so the investor can retire earlier than 60.”

Judge Amrita Nandakumar had this to say of Fitzpatrick’s entry: “I am a fan of funds that go beyond thematic and seek to be goal-oriented in nature, especially if they are able to achieve what they promise!”

In this case, Fitzpatrick expertly meshed the fund’s exposures, Nandakumar said, making sure each piece works well with other parts of the portfolio.

Here are the exposures, as Fitzpatrick explains them:

Generation X for the win! 20thCentFox/Courtesy Everett Collection

“To me, this is target date ETF 2.0,” Nandakumar said. “I love how it speaks to the current challenges we are facing — needing our portfolios to generate current income while still seeking to achieve some capital appreciation, the likelihood of inflation in the short-term, and the very real challenge facing Generation X in carrying the burden of supporting both the boomers and the millennials in their lives. Nicely done!”

The real kicker — ahem, the ticker — for Jennifer Fitzpatrick’s winning submission is also best described in the author’s own words: “Unfortunately GENX is already taken by some pharmaceutical company. I’d call this one JENX.”

Fitzpatrick is a 47-year-old retired (that’s right, retired) former litigator and self-taught investor with a passion for personal finance. She uses ETFs, which she prefers over single stocks, to express investment convictions. On the day she spoke to ETF Wrap, she was considering an investment in a gold ETF

IAU,

noting the attractive entry points and the fact that “this market doesn’t seem to know what it wants to do with itself.”

Fitzpatrick isn’t quite a sandwich kid herself; her parents are still in good health, she said, and she doesn’t have children. But she observed a colleague who had the same workload she did, in addition to caregiving duties, and a few years ago, on a business trip with time to kill at the airport, “I started doing an odd experiment, [thinking about] where would I put her money. That’s where I came up with the idea.”

“My husband says it’s my hobby,” she said, “But I do it as a thought experiment a lot of the time. It took 8-9 years of disciplined, systematic buying” to be able to retire so young, she noted.

As stellar as JENX was, the ETF chosen as runner-up also spoke to Nandakumar.

Its creator, La Juana (LJ) Chambers Lawson, is also an amateur investor who loves learning about the process. Professionally, she’s founder & CEO of Tacit Growth Strategies and the best-selling author of “Master Grant Writing: A Project Manager’s Guide.”

“My ETF idea is out-of-the-box because it is an investment in freedom, localized control and justice,” Lawson wrote in her entry. “It’s an idea rooted in human rights that is for the sort of ESG investing that helps minority communities by empowering them to create, own and sustain for generations.”

The ETF would seek to fund U.S.-based ethnic minority and women-owned LLCs, with a primary interest in Black and Indigenous business owners lacking known familial ties to nations outside of the U.S., knowledge-based and/or professional service US SBA certified Minority Business Enterprises. Its ticker, appropriately, would be MBE.

Nandakumar applauded the fund’s set-up. It would employ “ESG practices that seem to be more specific and stringent than what seems to currently be available in ETF form, such as board diversity targets, equal pay reports and supplier diversity programs,” she said.

“It would also offer exposure to a select group of minority- and women-owned business enterprises [official MBEs] that have already been vetted and are receiving support by the fund’s sponsors separately. While one could argue that this represents two separate fund ideas, the exposure to established firms could help reduce the volatility from the exposure to the smaller enterprises, which is why I could see this potentially working in one fund.”

Exchange-traded sundries

MarketWatch will explore what digital tokens and bitcoin mean for your wallet in a two-day event, Investing in Crypto, April 7 and 14 at 1 p.m. Eastern. MarketWatch and Barron’s journalists will convene top experts, including Galaxy Digital’s Michael Novogratz; Securities and Exchange Commissioner Hester Peirce; Sheila Warren, deputy head of C4IR at the World Economic Forum; and more. Register now!

Innovator Capital Management, pioneers of the “defined outcome” ETF strategy, announced a new flavor of funds launching April 1. The Innovator Accelerated ETFs seek a multiple of upside return of a reference asset, up to a cap, with one downside exposure. For example, the Innovator U.S. Equity Accelerated ETF — April will seek double the upside performance of SPY

SPY,

to a cap, with single exposure to it on the downside, over a one-year period.

Alternative-investment managers AXS Investments on Wednesday announced the hire of ETF pioneer Ben Fulton as managing director for global business development. Fulton has been in the industry for more than 35 years and is known for his time with PowerShares, during which he oversaw product development and later ran the global ETF business for Invesco.

Is there an ETF for that?

By now you’re probably familiar with the idea of crowd-sourced investment strategies: you’d have to be living under a rock, or perhaps a custom basket, to have missed the splashy rollout of one of that space’s new entrants.

But it’s not a new idea, and the adviser to one fund that has used the strategy quite successfully for the past two years would like you to know what makes it different.

The SoFi 50 ETF

SFYF,

tracks an index of the 50 securities that are held most frequently, and in the greatest dollar weight, in SoFi brokerage accounts. It’s a “more intelligent” way to crowd-source investments than simply relying on social-media chatter, said David Dziekanski, portfolio manager at Toroso, SFYF’s adviser. “What we say to the world and what we do can be two very different things.”

Those two screens, which Dziekanski describes as selecting for both breadth and conviction, produce a diverse list of investments, what he calls “a unique yin and yang.” Tesla Inc.

TSLA,

has long been “a stalwart,” but there are also growthy names like Amazon.com Inc.

AMZN,

and NVIDIA Corp.

NVDA,

as well as cyclicals like Ford Motor Co.

F,

and Southwest Airlines

LUV,

The index rebalances monthly, which means it’s “not always rotating into the craziest names that are just at the top of the news cycle,” Dziekanski said. Waiting just a bit until the hottest fad has proven its staying power adds momentum to breadth and conviction, he notes.

In the year to date, the fund is up 8.1%, better than the S&P 500’s

SPX,

5.8%, and over the past 12 months has returned 99.5%. Year-to-date performance may be somewhat influenced by the presence of some of the Reddit crowd’s favorite meme stocks, such as GameStop Corp.

GME,

and BlackBerry Ltd.

BB,

The fund charges a 29-basis-point fee, and has $16.2 million in assets, according to FactSet data.

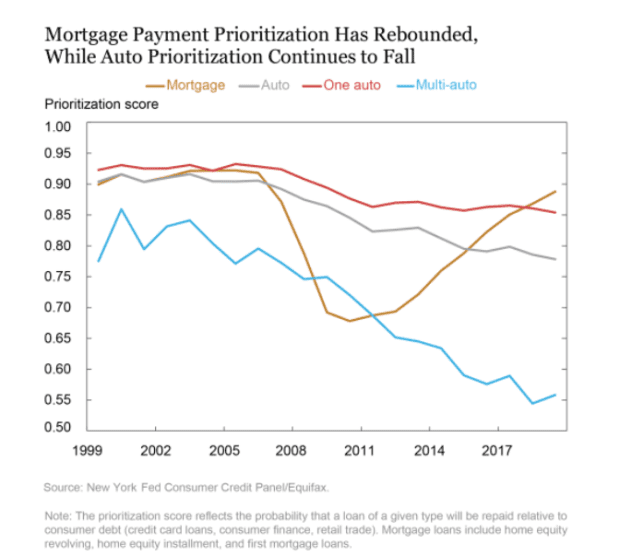

Visual of the Week

Weekly rap

| Top 5 gainers of the past week | |

|

First Trust Nasdaq Retail ETF FTXD, |

9.3% |

|

VanEck Vectors Rare Earth/Strategic Metals ETF REMX, |

9.1% |

|

Invesco S&P SmallCap Consumer Discretionary ETF PSCD, |

9.1% |

|

Invesco S&P SmallCap Value with Momentum ETF XSVM, |

8.1% |

|

VanEck Vectors Steel ETF SLX, |

7.7% |

| Source: FactSet, through close of trading Wednesday, March 31, excluding ETNs and leveraged products | |

| Top 5 losers of the past week | |

|

AdvisorShares Pure US Cannabis ETF MSOS, |

-9.7% |

|

iShares Evolved US Media and Entertainment ETF IEME, |

-5.8% |

|

Roundhill Streaming Services & Technology ETF SUBZ, |

-5.8% |

|

Global X Education ETF EDUT, |

-4.9% |

|

Sprott Junior Gold Miners ETF SGDJ, |

-4.7% |

| Source: FactSet, through close of trading Wednesday, March 31, excluding ETNs and leveraged products | |

MarketWatch has launched ETF Wrap, a weekly newsletter that brings you everything you need to know about the exchange-traded sector: new fund debuts, how to use ETFs to express an investing idea, regulations and industry changes, inflows and performance, and more. Sign up at this link to receive it right in your inbox every Thursday.