This post was originally published on this site

Market forecasters increasingly are touting the boom times they expect are in store as the U.S. economy emerges from the COVID-19 pandemic. A century ago, Americans were emerging from not just the Spanish Flu pandemic but World War I. The 1920s is a powerful analogy, conjuring up images of a society letting loose and breaking free — everything from dancing the Charleston to bidding the stock market up to previously unheard-of heights..

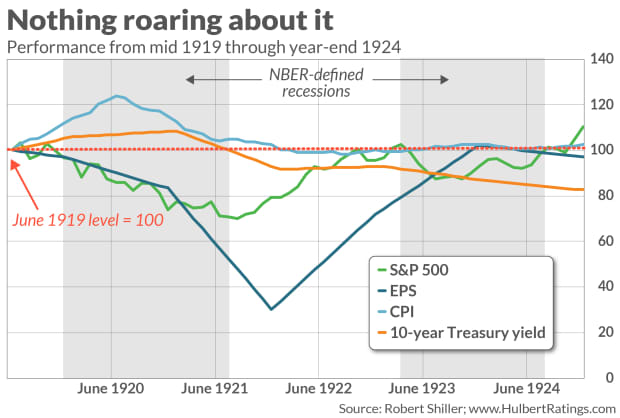

We can only hope that the U.S. stock market in the 2020s is nothing like the “Roaring ’20s” was.

Unfortunately, this is yet another case in which our historical memories are unreliable. The stock market in the 1920s didn’t really produce above-average performance until the latter half of the decade. The first half contained not just one, but two, economic recessions — and plunging corporate profits.

The chart below paints the picture. It begins in mid-1919, which is approximately when the third and final wave of the Spanish Flu pandemic was considered over. Notice that, between then and the half-way point of the next decade, half of the time was spent in a recession. At the end of 1924 the S&P 500

SPX,

as well as earnings per share, were no higher than where they stood in mid-1919.

If the next few years were to follow the same script, the S&P 500 at the end of 2024 would be trading at about 3,000, or 25% below current levels. Meanwhile, earnings per share for the S&P 500 over the trailing 12 months would total about $135—about 14% below current estimates for calendar 2021.

Clearly, the bulls need to come up with a better analogy. Particularly chilling is the behavior of the Consumer Price Index in the early 1920s. While it closed 1924 at more or less the same level as in mid-1919, notice from the chart its alarming rise in the 12 months following the end of the Spanish Flu pandemic’s third wave. Over that period inflation was running at a more than 20% annual pace. This experience is perhaps relevant to today, since inflation expectations have risen markedly in recent months and investors are wondering whether the increase is just a temporary blip or the beginning of a longer-term trend.

To be sure, few if any are suggesting now that inflation could rise to 20% or more in the next year or two. In order make the case that it will not, the analogy to the 1920s loses credibility.

Getting history right is important

Getting history right is important, since even if history doesn’t repeat it nevertheless rhymes. But if our reading of history is as bad as those who today are hearkening back to the Roaring ’20s of a century ago, we can’t expect the future to even rhyme with the past. We might just as well flip a coin.

The lesson I draw from my analysis of the 1920s is that Wall Street buys the rumor and sells the news. The stock market soared in late 1918 and the first half of 1919, as more and more investors “bought the rumor” that the pandemic’s end was imminent. That left relatively little upside potential for the stock market when the end finally came, and so investors “sold the news.”

It’s quite plausible we’re playing through such a scenario today. The stock market has surged over the past year, as successful vaccines were created, mass produced, and then administered. The Nasdaq Composite

COMP,

has almost doubled since its March 2020 low, while the S&P 500 is up close to 80% on a dividend-adjusted basis. It would be entirely consistent with a true Roaring ’20s scenario for the economy and stock market to suffer once the pandemic is truly declared over.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

More: ‘Increasingly euphoric’ stock-market sentiment on verge of sending ‘sell’ signal

Plus: Will individual investors stick around after pandemic’s ‘mind-blowing’ stock trading surge?