This post was originally published on this site

The S&P 500 eked out yet another record close on Wednesday, as the Federal Reserve reassured investors that it is in no rush to tighten fiscal policy — and that momentum has continued into Thursday.

But it may not last for long.

Our call of the day is that a number of technical factors suggest that the index is currently overbought and likely to be dragged lower in the short term, according to Michael Kramer of Mott Capital Management.

Last week, Kramer outlined how the March 2020 uptrend in the S&P 500

SPX,

was being challenged, and that the index had to break higher to avoid falling through the trend line. And it did: the index hit a record on Monday to start the trading week off on a positive note that has carried through the past few days.

However, momentum has stalled with the index around 4,080 points. According to Kramer, based on the concentration of stock market options contracts, the index is more likely to move to 4,000 points than 4,100 points. This is because it seems like most of the “gamma” is focused on 4,000, Kramer said. Gamma is a key measure of risk in options trading.

Kramer said that this concentration will prevent the index from moving much higher, especially given that options contracts expire next week.

In addition, based on the Bollinger band, which is a statistical measure characterizing price and volatility over time, the S&P 500 is already overbought, Kramer said. This “will likely result in a drop to fill some of the opening gaps, with the potential of it falling to 3,960,” he said.

Meanwhile, Kramer noted that the total volume of call options — the right to buy a stock at a certain price — is continuing to drop across the market. This has been a significant factor in helping the Cboe Volatility Index, or VIX

VIX,

to sink well into pre-pandemic territory.

The buzz

Apple

AAPL,

will argue that it faces “abundant” competition in the videogame transaction market in its lawsuit against Epic Games, according to a report from Reuters. The technology giant faces antitrust allegations from the developer of “Fortnite,” centering on Apple’s control over app and in-app purchases, including its commission of up to 30%.

Federal Reserve Chair Jerome Powell and International Monetary Fund managing director Kristalina Georgieva will discuss the global economy at noon Eastern. Elsewhere on the economic front, 744,000 Americans filed for unemployment last week, a rise from 719,000 in the week prior and outpacing expectations of 694,000. Continuing jobless claims came in at 3.73 million.

More than 3,200 workers at Amazon’s warehouse in Bessemer, Alabama voted on whether to unionize last week, representing 55% of the location’s total workers. The public portion of the vote count is expected to be released on Thursday or Friday.

Billionaire Peter Thiel, the co-founder of payments system PayPal

PYPL,

and Palantir Technologies

PLTR,

has warned that China may be using bitcoin to undermine the U.S. Thiel said that China wants to see two global reserve currencies — not just the dollar — and is trying to elevate bitcoin

BTCUSD,

to fill that second role.

In case you missed it: Minutes from the March meeting of the Fed showed that officials at the central bank seem divided into two camps about the outlook for inflation. The bankers also made it clear they wouldn’t slow the rate of bond purchases soon.

The markets

U.S. stocks were higher, near record levels

DJIA,

COMP,

It is the same in Europe, where equities finished the day in the green

SXXP,

PX1,

after investors there had a first chance to react to the Fed minutes confirming a continued loose stance on fiscal policy. Asian stocks were mixed but mostly finished the day higher

NIK,

The chart

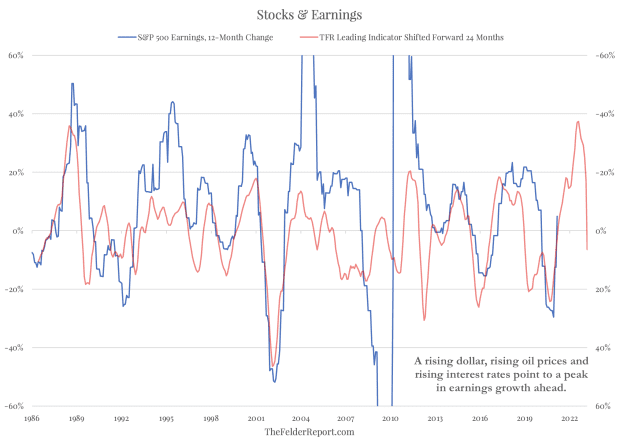

Interest rates, oil prices, and the dollar index are all rising, meaning that earnings growth will likely peak and rollover next year, according to Jesse Felder of the Felder Report blog.

An integral part of the rally in stocks over the past year has been the rebound in earnings, which is set to continue over the next few quarters. But our chart of the day, from Felder, shows that the bearish reversal in fundamentals — which are discounted by the market more than a year into the future — could hit stocks soon.

Random reads

A couple from Washington state won the lottery twice with tickets from the same store.

Up, up, and away: A 1938 comic book featuring Superman’s first appearance sold for a record-breaking $3.25 million at auction.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.