This post was originally published on this site

U.S. company spending on areas such as stock buybacks is poised to pick up this year after cash rose to record levels during the pandemic, according to Moody’s Investors Service.

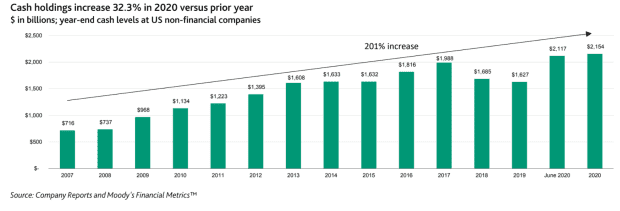

Cash holdings of non-financial companies in the U.S. surged 32% last year to an unprecedented $2.15 trillion, setting them up to spend more on capital investments, dividends, acquisitions and share repurchases, Moody’s said in a report this week. Most of the record cash is held by companies with investment-grade ratings, with overall holdings tripling since 2007.

“With an improving, though varied, business sentiment we expect repurchases by U.S. non-financial companies will rise in 2021,” Moody’s said. Share buybacks had been “significantly lower” last year amid difficult economic conditions induced by the pandemic.

Technology giants Apple Inc., Google parent Alphabet Inc.

GOOGL,

Microsoft Corp.

MSFT,

Amazon.com Inc.

AMZN,

and Facebook Inc.

FB,

are the top five most cash-rich companies rated by Moody’s. The tech sector has the largest cash holding at $888 billion, or 41%, of the total, followed by retail, healthcare/pharmaceuticals, and manufacturing as the next “most cash-flush” industries.

“These four industries held $1.427 trillion, or 66%, of total corporate cash at the end of 2020,” Moody’s said.

See: Get ready for stock buybacks to roar back

Based on credit grades, the largest share of the record cash is held by companies in Moody’s “Baa bucket,” representing the lowest levels of investment grade. This is the first time that corporate borrowers with single A ratings did not hold the most cash, according to the report.

Higher cash levels were driven up in part by increased borrowing as companies sought “to bolster liquidity” last year, Moody’s said. “Debt is up sharply,” rising to a record level relative to a measure of companies’ earnings.

Read: Beware heightened risks of ‘fragility shocks’ in a market too dependent on the Fed, BofA warns

“We expect growth in aggregate spending on capital investments, dividends, acquisitions and share buybacks will be about $1.8 trillion – $1.9 trillion in 2021,” said Moody’s. That’s up from $1.7 trillion in 2020, when share repurchases and acquisition spending dropped amid economic lockdowns in the COVID-19 pandemic.

Share repurchases, net of stock issuance, slumped 36% last year to $229 billion, according to Moody’s. The credit rater said that buybacks in 2020 were down 51% from their record in 2018, the year total company spending peaked at $2.13 trillion.

Buybacks have long been popular with technology stocks.

Tech companies led share repurchases for a 14th straight year in 2020, representing 92% of the total, according to the report. Apple

AAPL,

alone repurchased $76 billion of its shares last year, more than double the volume bought by Alphabet, underscoring tech’s dominance in buybacks.

“The next two closest sectors were retail at $16 billion and healthcare/pharmaceuticals at $12 billion,” Moody’s said.