This post was originally published on this site

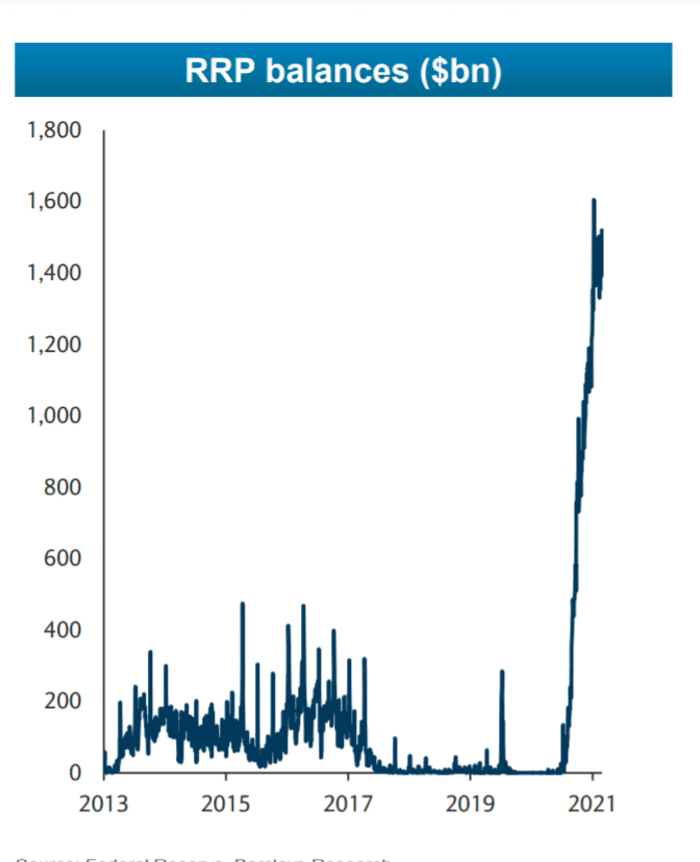

Demand for the Federal Reserve’s popular reverse repurchase program (RPP) climbed to $1.58 trillion on Monday, signaling continued high demand for the overnight facility as 2022 kicks off.

Wall Street has been regularly parking more than $1 trillion overnight in the Fed facility since early August, with demand hitting a peak thus far of about $1.76 trillion in late December.

Demand for Fed repo program regularly topped $1.5 trillion in the final weeks of December 2021.

Barclays, Federal Reserve

Use of the facility has remained high even after the Federal Reserve last month signaled it would no longer look to offer its full arsenal of pandemic support for financial markets in 2022.

Read: Sticky inflation, bigger paychecks, fading stimulus – how the U.S. economy is shaping up for 2022

But Fed Chairman Jerome Powell, in a more hawkish December pivot, also said the central bank doesn’t want to make drastic moves and upset the economic recovery, even while it seeks to tackle 1980s levels of inflation. The reverse repo facility has been viewed as a powerful and stabilizing force for markets during the pandemic.

“The RRP rate is effectively the Fed’s interest-rate floor,” a Barclays interest-rate research team led by Joseph Abate wrote in a Monday note to clients. “It is designed to mop up cash from investors who do not have the ability to earn IOER,” the team wrote.

The Fed has been paying users of its reverse repo program 5 basis points on overnight balances of up to $160 billion. The Fed also pays interest on excess reserve balances (IOER), roughly at a 10-basis-point spread to the RRP rate as of late 2021, according to Barclays.

Demand for the Fed facility mostly has been coming “from money funds, dealers and the GSEs,” Abate’s team said, referring to government-sponsored entities such as Freddie Mac

FMCC,

and Fannie Mae

FNMA,

Wait for October

Hoards of cash looking for a temporary haven during the pandemic have found a home at the repo program, particularly when faced with a shrinking Treasury-bill market as the Fed vastly expanded its balance sheet through bond-buying. Its current size is about $8.8 trillion.

But reducing some monetary support is different from the Fed actually shrinking its balance sheet, also referred to as “quantitative tightening” (QT) — when a central bank lets bonds mature without buying replacement securities, or by a more dramatic outright selling of assets it holds.

In a Dec. 22 note to clients, BofA Global’s rates team said the Fed was unlikely to sell its assets outright, but instead begin QT in October 2022 by shrinking its holdings of Treasury

TMUBMUSD10Y,

and mortgage-backed securities as they mature.

The result on financial markets likely will bring higher levels of Treasury issuance to the public and reduced liquidity, they said.

“For every $1 of Treasury holdings that mature off of the Fed’s portfolio, the U.S. Treasury Department needs to increase issuance to the public by a similar amount,” according to the BofA Global team.

The 10-year Treasury note hit 1.6% on Monday in the first session of 2022, a high last seen in November, while the Dow Jones Industrial Average

DJIA,

and S&P 500

SPX,

index closed at record highs.

Meanwhile, Barclays analysts estimate that the repo facility, together with bank reserves, represents about $3.5 trillion in excess liquidity in the system.