This post was originally published on this site

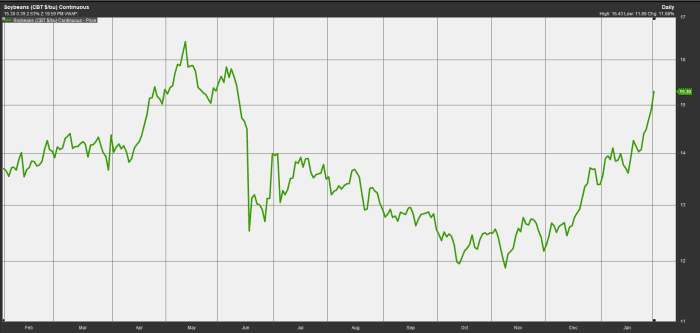

Soybean futures rose sharply on Tuesday to settle above $15 a bushel for the first time since June, as drought conditions in southern Brazil led to lower production estimates for the country, which is among the commodity’s top producers.

“Soybeans bulls are enjoying a perfect storm at the moment,” said Sal Gilbertie, president and chief investment officer at Teucrium Trading. “The near-term increase in global demand for soybeans is facing a simultaneous decrease in expected supply due to weather disruptions in South America.”

The most recent round of private estimates for South American production show “another downward revision of soybean production due to bad weather in Southern Brazil,” he told MarketWatch. Some private estimates are now approaching sub-120 million metric tons of soybean production, compared with last year’s 138 million metric tons, he said.

In a report released Jan. 12, the U.S. Department of Agriculture estimated Brazil’s soybean production for 2021/2022 marketing year at a 139 million metric tons, down 5 million metric tons from last month’s estimate.

Soybean prices have climbed because of the “Brazilian crop failure,” said John Payne, senior futures and options broker and market strategist with StoneX Financial, Daniels Trading Division.

Some traders were expecting 142 million metric tons, but it looks as if it is going to be closer to 126 million metric tons, he told MarketWatch. That’s 14 million metric tons, or 350 million bushels, that will “have to come from somewhere else.”

The United States Department of Agriculture, or USDA, also lowered the soybean yield estimate for Brazil by 3% to 3.44 tons per hectare, citing “historic dry conditions during November and December during critical reproductive crop states in the southern state of Paraná,” in southern Brazil.

“Also, the soybean crush is very profitable right now, led by high soybean oil prices, which, along with recent soybean purchases in U.S. markets by China, is keeping the demand for soybean quite robust,” said Gilbertie. The soybean crush is described by the CME Group

CME,

as the crushing process which leads to the production of soybean oil and soybean meal.

Current high soybean oil prices are creating more demand for soybeans, which are used to produce the soybean oil, said Gilbertie.

The most-active March soybean futures contract

SH22,

S00,

climbed 38 cents, or 2.6%, to settle at $15.28 ½ a bushel on Tuesday. That is the highest finish for a most-active contract since June 10, according to Dow Jones Market Data.

FactSet

StoneX Financial’s Payne expects the rally in soybean futures to continue.

“Chinese demand should slow because their crush is not moving like the U.S.” but, given the edible oil markets such as canola, bean oil, sunflower oil and palm oil are so tight, “there is a lot of need to continue to crush,” said Payne.

“Watch bean oil and meal, they will lead soybeans,” he said.