This post was originally published on this site

Analysts are debating whether U.S. inflation has peaked, but the relationship between two sensitive stock-market sectors signals that investors don’t think the economy has yet seen the worst of price pressures, a technical analyst argued Wednesday.

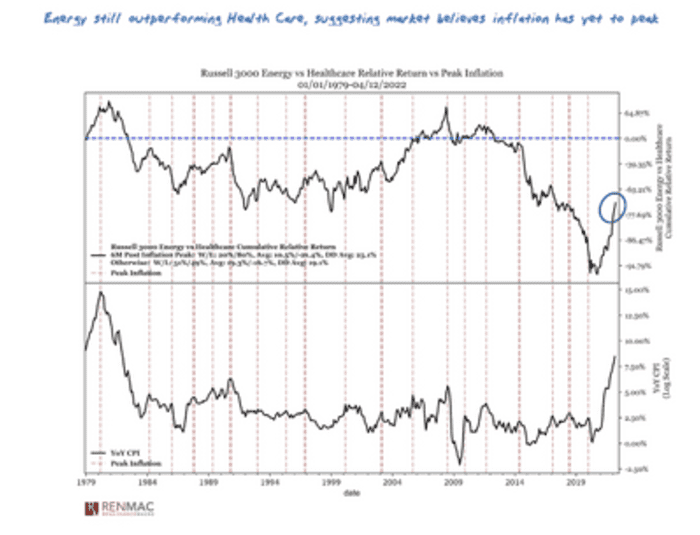

The relative performance of the energy sector versus health care serves as a real-time indicator of investor perceptions of peak inflation, said Kevin Dempter, analyst at Renaissance Macro Research, in a note.

Historically, a peak in inflation — defined as the highest consumer price index reading in 12 months which isn’t exceeded in the following 12 months — has subsequently seen the health care perform the best out of Russell 3000 index

RUA,

sectors, while energy has been the worst performing, Dempter wrote. So far, however, energy continues to lead (see chart below).

Renaissance Macro Research

“Health Care has been heating up lately but following yesterday’s strong CPI number, Health Care underperformed the market while Energy was leadership on the day,” he wrote. “Energy remains in a strong relative uptrend vs Health Care suggesting the market still believes inflation has yet to peak.”

The debate over a peak in inflation came after the March consumer price index on Tuesday showed a hotter-than-expected 8.5% year over year rise, the hottest since 1981, but a slowdown in the monthly increase in core inflation, which strips out the volatile food and energy prices.

See: Peak inflation? What’s next for U.S. as markets debate hottest CPI in more than 40 years.

The U.S. producer price index on Wednesday showed the cost of wholesale goods and services jumped 1.4% in March largely because of more expensive gasoline and food, signaling that U.S. inflation is likely to stay near a 40-year high through the spring.

Read: The worst may be over, but Americans to keep paying a high price

U.S. stocks were inching higher Wednesday after failing to hold gains scored in the previous session following the CPI reading. The Dow Jones Industrial Average

DJIA,

was up 126 points, or 0.4%, at 34,347, while the S&P 500

SPX,

rose 0.5% and the Nasdaq Composite

COMP,

jumped 1.3%.