This post was originally published on this site

U.S. stock futures struggled to make headway Thursday as traders absorbed the fallout from the latest Federal Reserve interest-rate decision.

How are stock-index futures trading

-

S&P 500 futures

ES00,

-0.58%

dipped 4 points, or 0.1%, to 3764 -

Dow Jones Industrial Average futures

YM00,

-0.45%

fell 26 points, or 0.1%, to 32152 -

Nasdaq 100 futures

NQ00,

-0.71%

eased 16 points, or 0.1%, to 10928

On Wednesday, the Dow Jones Industrial Average

DJIA,

fell 505 points, or 1.55%, to 32148, the S&P 500

SPX,

declined 96 points, or 2.5%, to 3760, and the Nasdaq Composite

NQ00,

dropped 366 points, or 3.36%, to 10525. The Nasdaq Composite fell for a third consecutive session, taking its loss over that time to 5.2%, and its decline so far in 2022 to 32.7%.

What’s driving markets

Stock indices were striving to stabilize on Thursday after yet another very choppy session in the wake of the Federal Reserve’s latest policy announcement.

The Fed on Wednesday delivered the expected 75 basis point interest rate hike to a range of 3.75% to 4%, but subsequent comments from Chair Jerome Powell dashed hopes that the central bank would soon pause increasing borrowing costs.

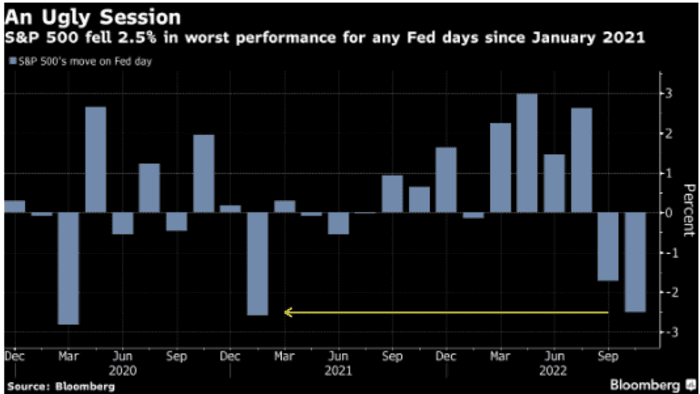

The S&P 500 turned a 1% gain into a 2.5% loss after Powell suggested that with inflation showing few signs of sliding notably from near 40-year highs, the Fed may reduce the speed of rate hikes but may extend the journey. It was the worst performance for a “Fed day” since January 2021, according to Bloomberg.

Source: Bloomberg

The S&P 500 is down 21.1% in 2022 as the Fed has raised borrowing costs from effectively zero since the start of March.

“The Fed’s new direction looks like a long string of smaller hikes with higher terminal rates,” said Stephen Innes, managing partner at SPI Asset Management. “Investors’ ability to absorb another backup in rates and the power of corporates to adjust to a higher for longer cost of the capital environment remains a crucial question for risk markets.”

Robert Bayston, head of U.S. government and mortgage portfolios at Insight Investment, said further bouts of market volatility were highly likely as the Fed continued to manage market expectations while making clear the end of its hiking cycle is not yet in sight.

“The challenge for the Fed will be to communicate to the market its desire to keep monetary policy and financial conditions tight over the medium term. It may do this by continuing to deploy hawkish rhetoric,” said Bayston.

Julian Emanuel, senior strategist at Evercore ISI, reckons that Powell’s “hawkish message underpins volatility into and beyond the 11/8 Election. A retest of the October lows, particularly [by the] growth centric Nasdaq 100, becomes base case”.

U.S. economic updates set for release on Thursday include weekly initial jobless claims, foreign trade deficit data for September, and third quarter productivity numbers, all at 8:30 a.m. Eastern. The ISM services index for October and September factory orders reports will be published at 10 a.m.

Meanwhile, it’s a very busy day for corporate earnings, including Moderna

MRNA,

Peloton

PTON,

and Under Armour

UAA,

before the opening bell, with Starbucks

SBUX,

PayPal

PYPL,

and Warner Bros Discovery

WBD,

after the close.

The Fed’s resolutely hawkish stance has revived buying of the dollar, pushing the euro

EURUSD,

down 0.4% to $0.9775. Sterling

GBPUSD,

was off 0.6% to £1.1325 ahead of an expected 75 basis point rate rise by the Bank of England.