This post was originally published on this site

https://i-invdn-com.investing.com/news/LYNXMPEE2K0EW_M.jpg

Investing.com — The world’s biggest brewer forecast another year of solid growth despite a slowdown in sales at the end of 2022.

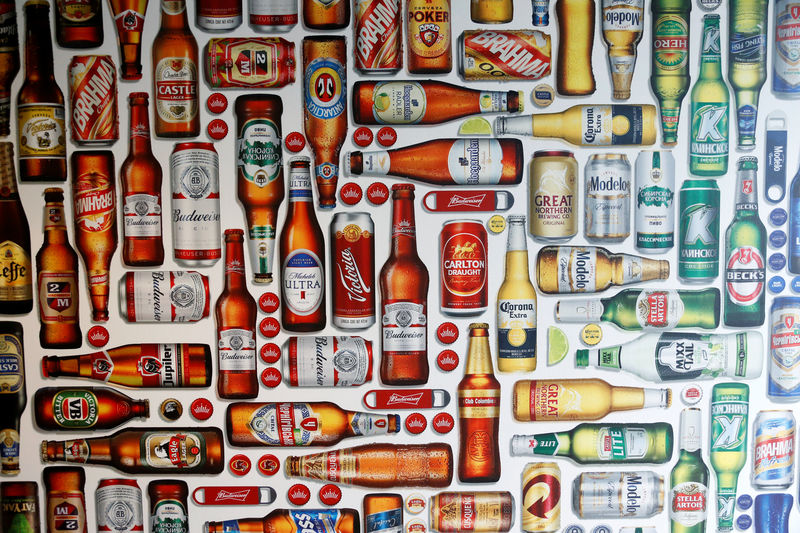

Anheuser Busch InBev (EBR:ABI), the owner of Budweiser and Stella Artois beer brands, said it expects earnings before interest, taxes, depreciation and amortization to rise by between 4% and 8%, in line with its medium-term targets, on what it called a “healthy mix of price and volume” effects.

However, it starts 2023 without much momentum: sales volumes fell 0.6% from a year earlier in the fourth quarter, the first quarterly decline since the start of the pandemic. Sales volumes were particularly weak in North America, falling 8.6% on the year as consumers turned away from its premium brands, and in Asia-Pacific, where they fell 2.3%. The declines were partly compensated by rises in Latin America.

Price increases allowed it to post a 10.2% rise in revenue, passing on big increases in input costs to its customers. Even so, revenue was still below a forecast of 11%.

Underlying earnings per share rose some 16% to 86c, comfortably ahead of a consensus forecast for 78c.

The company more than doubled its annual dividend to 75c a share, as strong cash flow allowed it to pay down debt, leaving more left over for shareholders. Gross debt, which has been a constant bugbear for the company since its merger with SAB Miller, fell by $8.9 billion to just under $80B, while net debt fell to 3.51 times earnings before interest, taxes, depreciation and amortization as of the year-end, from a multiple of 3.96 at the end of 2021. Even so, the company expects to pay out as much as $230 million a quarter this year due to the higher prevailing level of interest rates.

AB InBev had – just – remained profitable through the pandemic, despite a sharp hit to sales in bars and restaurants in 2020. Last year saw it exceed its pre-pandemic sales volumes by 5.8%, with revenue some 10% ahead of 2019.

AB InBev stock responded weakly to the numbers, falling 4.0% to a two-week low at the open in Brussels before stabilizing.