This post was originally published on this site

If Ramit Sethi had his wish, we’d never use the phrase “financial literacy” again.

“People want to be rich! They want to live a life of freedom,” Sethi tells MarketWatch. “We have to change the framing of the way we talk about money.”

This has been Sethi’s mission over the last 20 years, since he started a blog called I Will Teach You To Be Rich when he was just out of Stanford. That turned into a New York Times bestselling book of the same name, a podcast and a program of classes and seminars. All that has led to a new Netflix

NFLX,

special, “How to Get Rich,” that drops on April 18 to what he estimates is 220 million people all over the world.

“Nothing reaches the scale of TV,” he says.

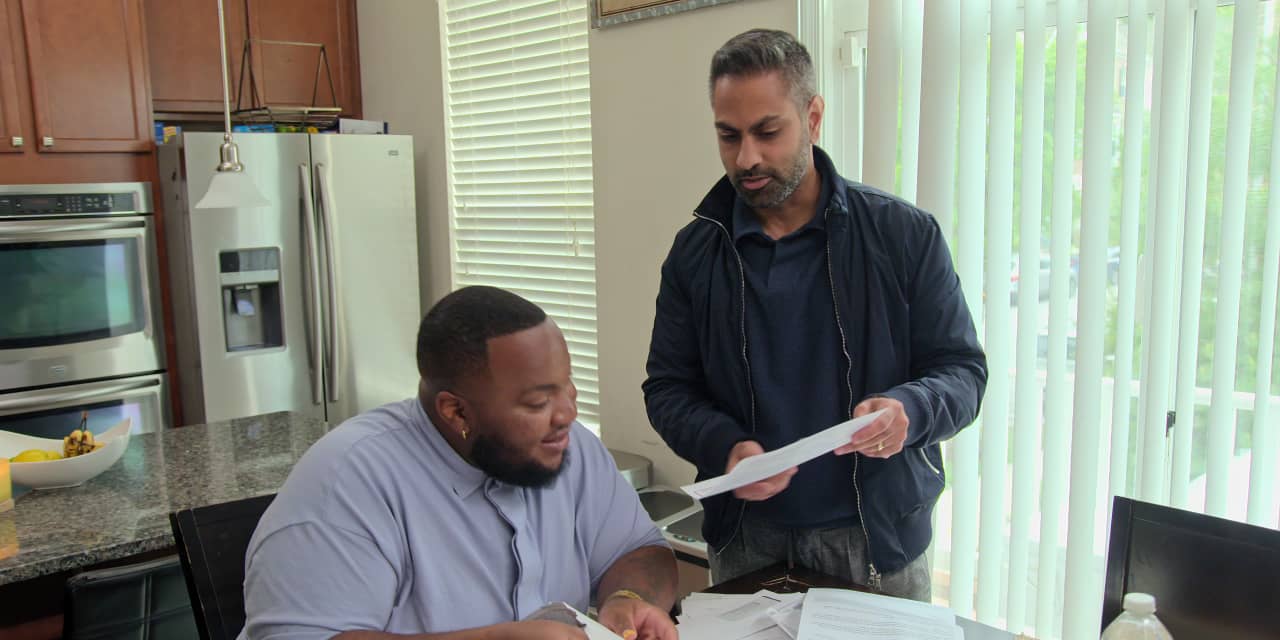

The 8-episode show is like a live-action version of his popular podcast, where he coaches people through their issues with money. Sethi is not a financial planner nor a licensed therapist. “I call myself a CEO and author,” he says, and his financial knowledge comes from a lot of applied work. He pegs his area of expertise as the intersection of psychology and money, rather than professional financial planning.

But that does not stop him from digging into the numbers. Before each encounter with a guest on the show, Sethi gets the bare financials – debt, income, savings and spending history – and then he works with them over the course of six weeks to help them get over their blocks. There’s some follow-up too, and a year after filming, Sethi is still in touch with the people he helped. “They’re so surprised that I text them out of the blue, that I care,” he says.

There’s only so much you can do for people in a short span of time, and really, progress is up to the individual, but one of the big lessons of the show is for viewers to see what’s going on with other people and apply it to their own lives.

Here’s some of what you can learn about getting rich from Sethi’s new show.

Look at real numbers

Estimates and guesses don’t work when you’re trying to figure out what’s going wrong with your spending, and platitudes and rules of thumb will only get you so far when you’re working on a financial plan. Sethi presses people in the show to look at their real numbers, even if it’s painful – and they comply.

“I learned that if you’re trustworthy, they’ll tell you everything,” Sethi says. “They forget the cameras are there. I was pleasantly surprised by how honest people are.”

That means on the show, people get called out for things like spending $2,000 on brunch in a month, holding on to a $400-a-month storage unit when the contents aren’t valuable and gambling $80,000 on DraftKings stock.

Avoid industry traps

The financial industry can make money unnecessarily complicated, to your disadvantage. Sethi spares no sympathy for financial advisers who charge yearly fees for assets under management, rather than fee-only planners who bill you for what they actually do.

“You ask them: How much do you charge? And they can’t give you a straight answer. I am critical of the confusion, although I have nothing against financial advisers per se,” he says.

Sethi is also brutal about online trading platforms that encourage people to trade individual stocks at their own peril, like Robinhood, which he calls out on the show.

“I’ve named names since the beginning,” Sethi says. “I think that’s why people trust me.”

But all that still does not convince some people to do things differently. One show participant, Nathalie, insists on keeping her money with a financial planner charging her a 1% fee no matter how Sethi tries to show her the math. “You could save hundreds of thousands of dollars doing it yourself or paying by the hour. But the more you explain the math, the more they become resistant to it,” Sethi says.

Look at what’s really going on

When Sethi runs into that aversion to changing poor financial habits, he doesn’t show charts and graphs, but instead asks questions to find out what’s behind it. “If they say they spent $5,000 on clothing, I ask to see it and tell them I love spending money on things too,” Sethi says. “Then I ask them what they think is going on.”

Sethi says most people have never been asked that kind of question about money and they find it can be very freeing to talk about where they developed their money values. They start to see connections. “Much later, when we get to the numbers, I communicate in a simple way. It really helps them see the important parts,” Sethi says.

Find representation and model behavior

You’ll see shopping on Rodeo Drive in Sethi’s Netflix show, but only as a cautionary tale. The people featured come from many walks of life and have all sorts of money issues – spending too much, earning too little, not paying attention to the big goals – but most are not what you would traditionally consider rich.

Sethi takes great pains to find a diverse group of people to spotlight, and that means a geographic, ethnic, racial, economic, age and gender spread that hopefully allows people to see themselves in the scenarios in some way.

“Representation really matters. It’s been a huge priority to get a very diverse set of people,” Sethi says. “Rich is not some old guy wearing a top hat. Rich is a person next door. Rich can be a schoolteacher.”

Find your rich life

Sethi isn’t coming for your lattes and avocado toast. “I’m not here to make anyone look stupid,” he says.

Digging deep into money psychology is more about figuring out how your feelings are driving your financial decisions. That’s why Sethi asks each guest to define their “rich life,” which is different for every person – like owning a house, being able to eat out at restaurants without considering the cost, starting a business, helping a parent retire. Sethi recently joked on Twitter that his rich life was never having to go do his own home repair again.

Sethi starts there because he knows that some people are ready to change and others are not, but before they can do anything, they need to decide what success looks like. When he started the show, Sethi spoke to the producers about what they wanted from these encounters. Was it massive transformations, like doubling their salaries? Not always.

“I learned that some people just want to take one step forward and some people aren’t ready to change at all,” Sethi says. “All of us can understand what it’s like to want to change but it’s harder than we thought. If we can tell that story, that’s a beautiful thing.”

April is National Financial Literacy Month. To mark the occasion, MarketWatch will publish a series of “Financial Fitness” articles to help readers improve their fiscal health, and offer advice on how to save, invest and spend their money wisely. Read morehere.