This post was originally published on this site

American workers’ expectations that they will live comfortably in retirement fell to the lowest level in 11 years amid high inflation and fears of a recession, according to the latest Gallup survey.

Just 43% of non-retired Americans’ think they will live comfortably in retirement, the most pessimistic rate since 2012. The sentiment dropped 10 percentage points since 2021, including five points in the past year.

This comes as 77% of retirees—unchanged from last year—say they currently have enough money to live comfortably.

Even still, Fidelity Investments said ‘we are optimistic for the future of retirement security,’ based on the strength of its first-quarter analysis.

Gallup said the non-retirees’ views have often been overshadowed by economic conditions. For example, during and after the Great Recession (from 2008 to 2013) and in the past two years amid high inflation and recession fears, less than 50% of non-retirees have been optimistic about their retirement.

Among eight financial matters, Americans worry most about having enough money for retirement. More than 70% of non-retired adults are at least moderately worried about being able to fund their retirement. This includes 42% who say they are very worried, Gallup said.

Lower-income non-retirees are especially uneasy about their retirement prospects, with a record-low 19% saying they expect to live comfortably and a record-high 88% expressing worry about having enough money to retire, Gallup said.

Those who are not worried about retirement? Men, as well as those younger than 30, those with higher incomes and college graduates are more likely than their counterparts to predict that they will have enough money to live comfortably in retirement, Gallup said.

Only 36% of women said they believed they would retire comfortably, compared with 50% of men. Women face several headwinds to their retirement since they tend to live longer than men, earn less than men during their careers, are usually the ones taking time out of their careers for family caretaking, and end up retiring earlier—often not by choice.

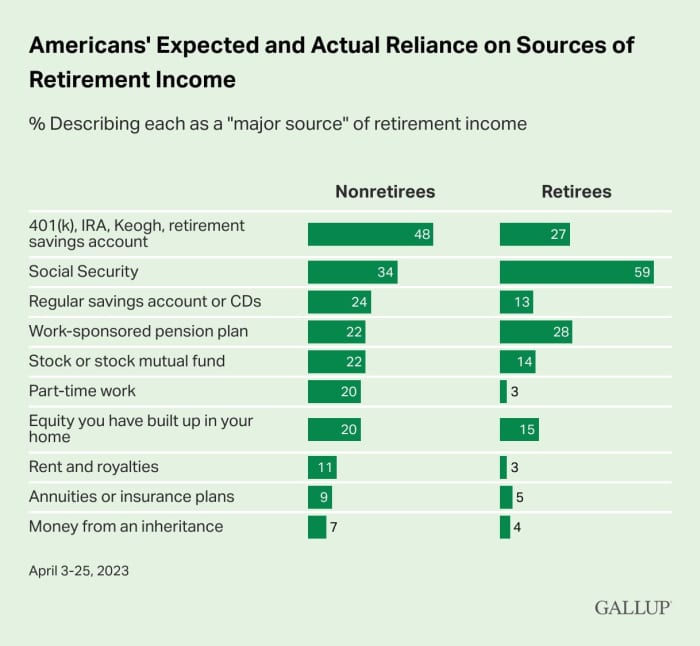

Gallup said non-retired Americans also differ from those who are currently retired when it comes to their retirement funding. About six in 10 retired adults report that Social Security is a major source of their retirement income—but far fewer non-retirees, 34%, expect it will be for them. The polling firms said that was consistent with Americans’ growing concerns about the solvency of Social Security.

Read: Will Social Security exist for millennials and Gen Z?

Instead, non-retirees expect they will rely more heavily on retirement savings accounts, including a 401(k) or IRA. This trend has persisted since 2001 when Gallup first tracked this measure. Currently, nearly half of non-retirees, 48%, think a 401(k), IRA or similar type of retirement savings account will be a major retirement income source, the highest of 10 potential sources.