This post was originally published on this site

https://images.mktw.net/im-75515534Did one of Wall Street’s biggest bears just turn bullish?

As Wall Street debates whether the powerful rebound in stocks and bonds trading around the world has more room to run, or has already gotten over its skies, Michael Wilson, Morgan Stanley’s top equity strategist, is telling clients that the Federal Reserve could be guiding the U.S. economy toward a “sweet spot” for the market.

Should the central bank succeed, small-caps and other corners of the market that have underperformed the S&P 500 in 2023 could be poised to continue ripping higher as a rebound “everything rally” that started in early November has shown few signs of slowing down.

Wilson pointed out that the Fed has seemingly shifted away from focusing primarily on inflation and toward preserving the trajectory of economic growth already seen this year.

If the central bank succeeds in pulling off a soft landing for the U.S. economy without triggering a reacceleration of inflation, stocks like small-caps, which tend to be more sensitive to changes in interest rates and the economic outlook, could be poised to build on the stunning rebound rally that began in November.

The iShares Russell 2000 ETF

IWM

has risen nearly 20% since Oct. 31. Last week, the ETF, which tracks the small-cap Russell 2000 index

RUT,

briefly touched its highest level since late July, according to FactSet data.

The S&P 500

SPX,

the U.S. equity market benchmark, is up 12.5% over the same period.

“This is a bullish outcome for stocks because it means the odds of a soft landing outcome have gone up if the Fed is going to start focusing more on sustaining growth rather than worrying so much about getting inflation all the way down to its 2% target,” Wilson said.

He added later that the U.S. economy could be entering a “sweet spot” that would allow stock-market laggards to catch up after one of the most lopsided years for U.S. equity-market performance in recent memory.

“If inflation stabilizes at a higher level, small-caps/cyclicals/lower quality stocks could be beneficiaries. Of course, this is a fine line with inflation statistics still running above target. Should these numbers start to rise again, the Fed could reverse course. Right now though, we could be entering a sweet spot that supports this rotation if nominal growth accelerates,” said Wilson.

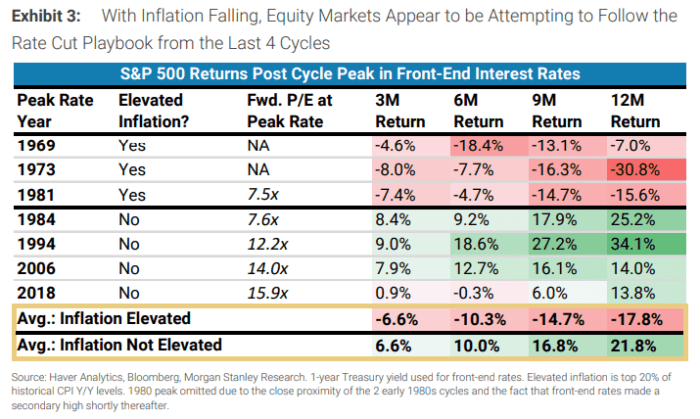

After taking a look at how stocks have performed in the past when the Fed has cut rates, Wilson concluded that there could be more room for the S&P 500 to run higher as well.

MORGAN STANLEY

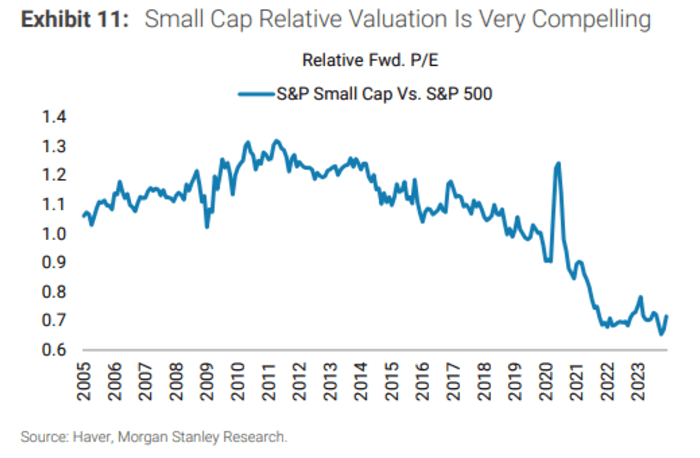

Despite these impressive gains over the past six weeks, small-cap stocks are still trading at a 30% discount to their large-cap peers based on analysts’ projections for corporate earnings in 2024, Wilson said.

MORGAN STANLEY

This isn’t the first time that Wilson, one of Wall Street’s most stubborn bears in 2023, has flirted with a slightly more moderate view. Back in July, he issued a mea culpa to clients as U.S. stocks marched higher.

Before that, Wilson was one of the few strategists on Wall Street who anticipated the selloff in stocks and bonds in 2022 that resulted in the worst calendar-year performance for the S&P 500 since 2008. But he maintained his bearish outlook heading into 2023, and his official forecast for 2024 is 4,500. That would represent a nearly 5% drop from where stocks were trading around midday Monday, with the S&P 500 at 4,744, according to FactSet.

More recently, Wilson dismissed the likelihood that stocks would rally in the fourth quarter, only to see the S&P 500 achieve its biggest monthly advance of 2023 in November.

See: Morgan Stanley’s Wilson: Next rally attempt will fail as investors are punishing earnings reports.